Excel Budget Template Download Free Personal For Mac

This article contains the Personal Budget Excel Template with graphs and predefined formulas. This Budget is for individuals. For Company Budget please. A personal budget is a financial plan that allocates your personal income towards routine expenses eventually helping to do savings or debt repayments. Budgeting is similar to dieting.

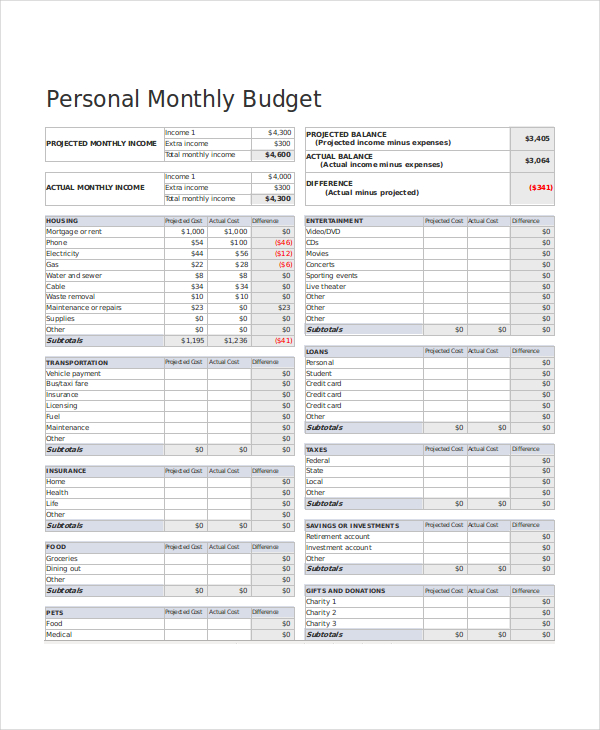

During a dieting, we make a schedule of what we eat and try to reduce the extra pounds that we have put on. We Similarly while Budgeting, we track our incomes and expenditures to decrease/cut-down unnecessary or unwanted expenses. In simple terms, a personal budget is an itemized summary of your income and expenses. It helps you determine whether you can grab a bite at a restaurant or head home for a bowl of soup. I have created a Personal Budget Template with predefined formulas and graphical overview of the financials.

You can also download other templates like, and by clicking on the name of the templates. This template is useful to everyone but especially to working individuals men or women, students and businessmen.

Let us discuss the contents of the Personal Budget Template in detail. Contents of Personal Budget Template This template consists of 4 sections: 1. Header Section 2. Income Section 3. Savings Section 4. Expenditure Section 5.

Graphical Overview Section 1. Header Section Header section consists of the heading of the Personal Budget template and the month for which the personal budget is prepared. Income Section In this section, you need to input all the different income generating sources of an individual.

Income generating sources include Salary, dividends, income from interest, rent income etc. Savings Section Saving Section consists general saving, money for any emergency situation, saving for retirement policies etc. This section can be customized as per your needs. Expenses Section This section consists of subcategories of expenses like general expenses, Travel, family expenses, recreation expenses, health expense and holiday expenses etc. General Expenses include rent, insurance, utility bills, ISP bills, maintenance etc. While travel expenses include car EMI, Auto Insurance, fuel, public transport and manitenance of personal vehicles. Family expenses consist of groceries, child care items, laundry, clothing etc.

Recreation expenses will include movies, DVDs, concerts other outdoor activities. Health expenses include the health insurance, gym fees, doctor’s fee, medicines etc. Holiday expenses include airfare, hotel, food rent a car etc. Graphical Overview Section The graphical Overview section consists the difference of incomes and expenses along with savings and how much more one can save additionally. This overview will give you an idea to plan for an early loan repayment or debt clearance. You can also plan for the purchase of an asset on the basis of these savings.

Both income and expenditure are shown graphically. The percentage-wise share of income, expenditure and savings is also shown in pie chart format. Importance of Budget – Planning and monitoring your budget helps you identify the wasteful expenditures. – Achieve your financial goals. – Creating a budget will decrease your stress levels because you will be ready for your upcoming expenses in advance. You will not have any surprises.

– Provides you with financial freedom. – Retire early. You start thorough planning, management and investing money from your savings you can plan your retirement. – You can manage your money and make early repayments of your loans and save on interests. – Repayment of loans and a handful of saving keeps you financially free. Helps live a life you want. – Serves as a mirror of your financial situation.

Personal Budget in nothing but efficient management of your money in such a way that you have enough saving and less or no debts. I would like put forth some Warren Buffet quotes which are very true and following his advice helped me a lot to come out of severe situations. SPENDING – IF YOU BUY THINGS YOU DO NOT NEED, SOON YOU WILL HAVE TO SELL THINGS YOU NEED. SAVING – DO NOT SAVE WHAT IS LEFT AFTER SPENDING, BUT SPEND WHAT IS LEFT AFTER SAVING. BORROWING – THE MOST IMPORTANT THING TO DO IF YOU FIND YOURSELF IN A HOLE IS TO STOP DIGGING. Thus, Budgeting is very important for everyone. Conclusions There are three kinds of budget results, Surplus, Balanced and Deficit.

Surplus budget means Actual expenditure is less that the estimated. Balanced Budget means that the estimated and actual expenditure are equal. Deficit Budget means that the actual expenditure is higher than the estimates. If your personal budget is a surplus budget, then profits can be anticipated. Whereas if your budget is a balanced budget, then we need to improve the execution.

But if our budget is a deficit budget, then high debts and losses can be expected. This eventually leads to bankruptcy. Thus, we need to prepare, plan and execute a budget plan that helps us to acquire a surplus budget.

We thank our readers for liking, sharing and following us on different social media platforms, especially Facebook. If you have any queries or questions, share them in comments below. I will be more than happy to help you.

Posted in category Do you want to track your income and expenses incurred regularly? The Personal Budget Spreadsheet helps in tracking, managing and calculating your personal income, expenses and savings. The first sheet is Personal Budget sheet that records the income, expenditure and savings details of an individual on monthly basis. This template includes most of the heads of expense.

We highly recommend you to keep this sheet updated regularly for a correct insight at all times. The spreadsheet helps you in setting some savings goal as well. The monthly breakage helps you in analyzing the months that you saved more and the ones in which you spent more. You can easily track different kinds of expenses incurred under heads like- home, daily living, transportation, etc. The sheet also gives the Potential To Save value for each month.

Using the spreadsheet Begin by downloading the template and recording your income and expenses into the spreadsheet. The first sheet is Personal Budget sheet that records the details of the entire sources of income and the amount received through each source. The various categories of the income included are:. Salary / Wages. Business.

Pension. Interest / Dividends. Miscellaneous The sheet has savings goal set for each month that one needs to achieve in order to have a good budgeting.

The savings goal can be a single goal or a set of projected goals. The net value of the savings goal is calculated on a monthly basis and also on a larger annual scale. The monthly analysis helps in getting an idea of the overall savings targets that a person sets and the amount that he/she is able to actually save. It also helps to take better decisions on your savings and expenditures. Home. Daily Living. Transportation.

Entertainment. Health. Holidays.

Recreation. Subscriptions. Personal. Financial Obligations. Miscellaneous Payments The net potential to save amount made by an individual can be calculated by subtracting the sum of Total Savings Goal and Total Expenses from Total Income. The value is calculated both on a monthly and annually basis.

The second sheet is Dashboards sheet that shows the summary of the personal budget sheet as four different graphs and charts. The four distributions are:.

Income The Income pie chart shows the percentage share of each kind of income that a personal receives. The chart helps to easily interpret the income head that has the largest share and the one with the least share. Expenses The bar chart representation of the expenses that is plotted on monthly to the amount of expense incurred. The bar of the various categories of the expenses for a month shows the share of each kind of expenditure. The same data is also plotted on a monthly table view of doughnut charts.

Free Budget Templates For Excel

Annual - Expense and Distribution Pie This pie chart shows the percentage share of annual expenses incurred by the person. You can easily know the category that consumes a major share of your income and the ones that could have been easily avoided. Income - Expense and Savings Chart The line chart depicts the status of the various categories like income, expenses for each month relative to the previous month. The categories that the chart showcase are.

Income. Expenses. Potential to Save.

Savings Goal What does the 'Potential to Save' value mean? The Potential to save is the amount of money a person can save in a month from your income.

The value would be achieved if the savings goals have been attained for the expenses that are incurred in a month. What does the Dashboards sheet do? The Dashboards sheet makes the understanding of the budget easier and simple with the help of graphs, charts, etc.

The reports give a summary of the personal budget on the basis of Income pie chart, Expenses bar graph, annual expense distribution pie chart and income expense and savings chart. The dashboard provides a summary of the various expenses and savings. It helps to make decisions for improving the savings and avoiding unnecessary expenses. Function used in template.

SUM(number1, number2, number3, number4.). Other Personal Budget Planning Resourses.

Advanced budgeting and professional advise, try it if you need something more than excel. You can also get $6.00 discount by clicking on the link.

The Budget Planner: Free tool and guide to managing your money. Great budget planning tools for Microsoft® Excel® from SimplePlanning.com. 11 ways in which budgeting can impact and significantly improve your life. 7 steps for creating your first simple budget. To build a realistic financial budget, begin by identifying your expenses. Related Content.